What We Do

“…in this world, nothing can be said to be certain, except death and taxes.”

Benjamin Franklin, 1789

In our experience, one of the above factors is something none of us particularly like to think about and one is something we don’t like to do. After all who likes paying tax?

If death is a certainty, then the question is why don’t more people do something as simple as making a Will in anticipation of their own death?

More than two thirds of people don’t make a Will, which effectively means they die intestate and their estate is distributed in accordance with prescribed rules which could mean that our next of kin inherit, not because they may be the most important people we wish to care for, but because they are the nearest to us by the chance of birth.

At Yourlife Planning we don’t like to leave things to chance and working with you we will help you develop your Yourlife Plan to ensure your affairs are in order, during your lifetime through the provision of Powers of Attorney, at the end of your life with a properly considered Will.

We will help your Executors and Trustees to deal with the legal process after your death and we’ll help ensure your estate passes as tax efficiently as possible to those people you would like to benefit.

We are here to help you create the legacy you want to leave behind in a sympathetic and meaningful way for the future enjoyment of those you would like to provide for.

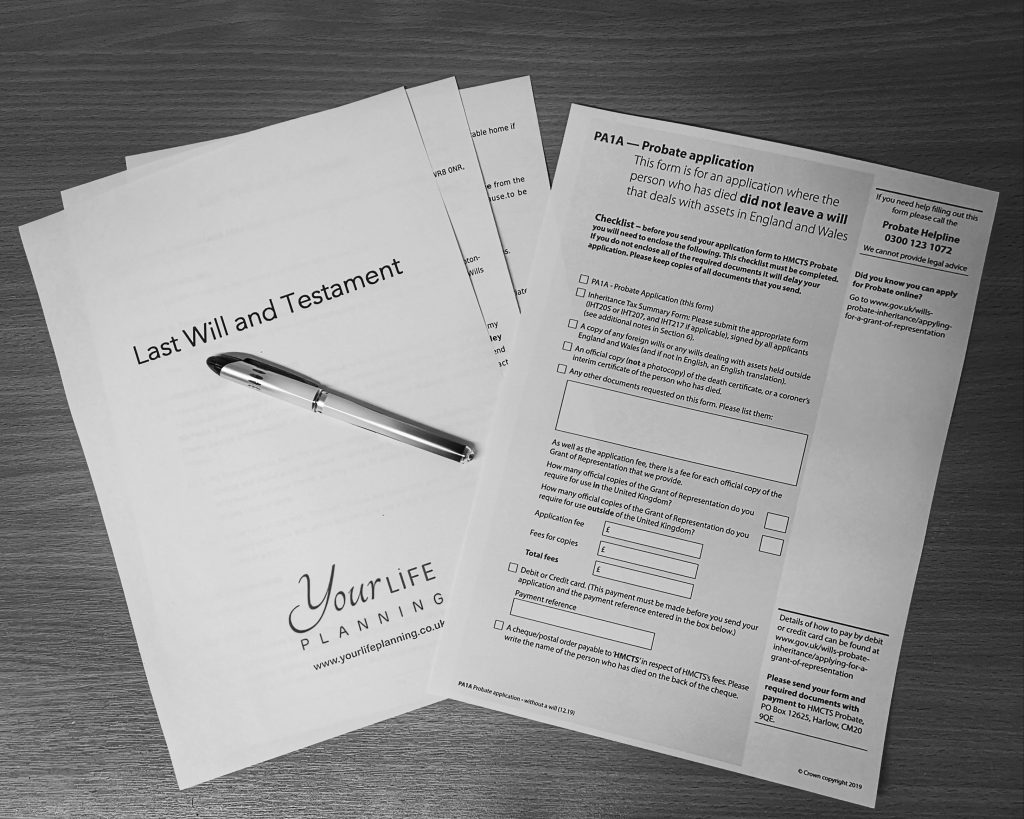

Will

A Will not only acts to establish how you want your estate to be distributed in the event of your death but it also acts to protect the people who are to benefit from your estate.

A Will is probably one of the most important documents you will ever create and it is therefore important to properly understand not only how your estate is made up but also the identify the provenance of the gifts you want to be distributed on your death so that the individuals inheriting your estate have a better understanding of where bequests have come from.

Living Will

A Living Will is a document that allows you to give your wishes for the types of medical treatment you would or would not want to receive. If, for example, you were in a coma or suffered a serious accident or long term ill health and you were unable to communicate your wishes.

Power of Attorney

In the event that you lack capacity for some reason, through accident, sickness or serious illness it is reassuring to know that there is a trusted person or people who can look after and manage your affairs on a daily basis for your benefit.

Setting up a Power of Attorney arrangement enables someone else you have chosen, your Attorney, to ‘stand in your shoes’ to look after your financial affairs, property matters and health arrangements in the event that you are unable to do so yourself. On regaining capacity you are then able to take back the authority to manage your own affairs and deal with things as normal.

Funeral Plans

Many individuals are keen to know that their affairs are in order in the event of death and this can extend to ensuring their funeral arrangements have been planned for which means that their family don’t have to worry about sorting these arrangements themselves following the death of the individual.

We offer a range of pre-paid plans from well-known companies and we can help you choose and formulate a plan which will meet with your wishes and save your family from the financial worry of having to sort things for you.

We’re great believers in you being involved in preparing for the end of your life, so why not take an active part in your end of life planning to ensure you have a ‘voice’ and that your ‘voice’ is heard at what will be an emotional time for your loved ones.

Assisting with Probate

Obtaining a grant of Probate to enable Executors to prove a Will and distribute the proceeds following the death of a loved one can be a daunting task, especially as there are a myriad of HMRC forms to complete and different allowances which can be claimed to reduce the incidence of possible Inheritance Tax.

We’re here to support you with a ‘helping hand’ process, which means we can complete the necessary paperwork for you to not only account for the estate of the deceased but help the Executors to claim any allowances which may be available to the estate.

Past experience has included not only providing a ‘helping hand’ for Executors, where all of the estate is located in the UK but also where part of the estate is located overseas.

The support we offer keeps you as the Executor in control but serves to help you do the right thing for the ultimate beneficiaries you are there to support.

The Vault

Dealing with your estate can be very challenging for your Attorneys or Executors, but having all your financial information in one place puts them in the best place to help you. We can help you setup your secure Vault so that your information is organised and ready to go when this is needed.